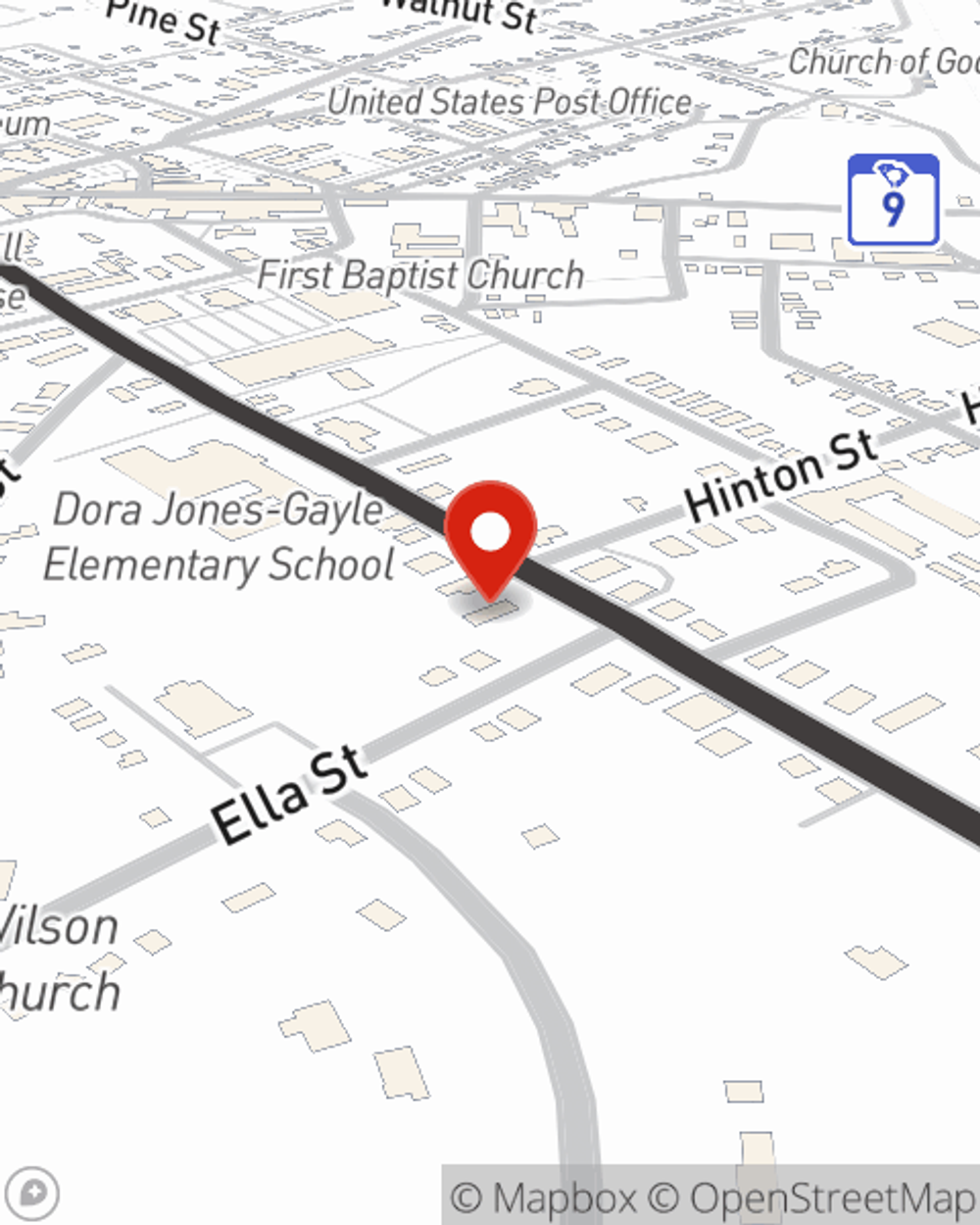

Business Insurance in and around Chester

Calling all small business owners of Chester!

No funny business here

- South Carolina

- North Carolina

- Georgia

- Great Falls

- Lancaster

- Richburg

- Winnsboro

- Rockhill

- York

Your Search For Remarkable Small Business Insurance Ends Now.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and extra liability coverage, among others.

Calling all small business owners of Chester!

No funny business here

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Chris Gaddy for a policy that covers your business. Your coverage can include everything from errors and omissions liability or business continuity plans to professional liability insurance or commercial auto insurance.

Reach out agent Chris Gaddy to explore your small business coverage options today.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Chris Gaddy

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.